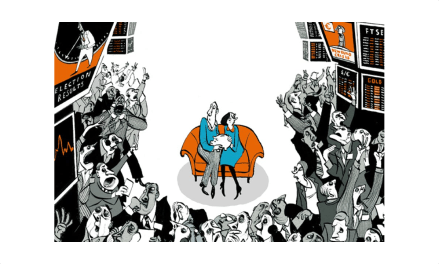

Wall Street madness: Trust, by Hernan Diaz, reviewed

‘I don’t trust fiction,’ the famous author told me, both of us several glasses to the good. ‘It contains too much truth.’ I nodded and she laughed and we drank more wine, but that sentence stayed with me in all its aphoristic glory. When she died, this was the first thing I remembered: our conspiratorial conversation in the deepest dark of 1990s Soho. This is not true. It has the feel of lived experience, yet it is entirely invented. The context, its placement and the fact that it is printed in a magazine gives it credence. As readers, we do not expect to be lied to. With a work of