Young and jobless: Is the government letting down China’s Generation Z?

32 min listen

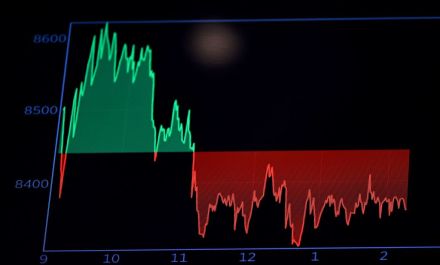

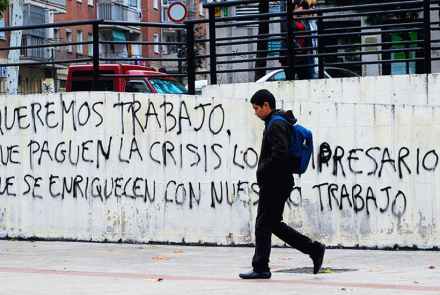

Hidden in March’s GDP figures was a shocking statistic – a fifth of Chinese 16 to 24 year olds are out of work. This is a near record high, and the economic background to a fresh wave of disillusionment among China’s young. It has led to the creation of a new meme – you’ve heard of lying flat, but young people are now comparing themselves to a Republican-era literary character, Kong Yiji. On this episode, I’m joined by the journalist Karoline Kan, author of Under Red Skies: The Life and Times of a Chinese Millennial. We talk about the Kong Yiji trend, why prospects are so thin for the most educated