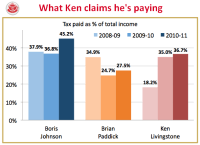

When it comes to personality, Boris will always win

The fight for London Mayor election has well and truly descended into a clash of personalities. Policies have all but disappeared while candidates trade attacks in the press. The Guardian, duly unimpressed, has written a scathing leader attacking both sides for this strategy: ‘The early days of the London campaign have fallen well short of what the voters are entitled to expect. Almost everything has been focused on the egos, lifestyles and personalities of the two main candidates, Boris Johnson of the Conservatives and Ken Livingstone for Labour. Mr Johnson, arguably a better mayor than some feared but evasive and woolly on the detail as ever, has run a deliberately