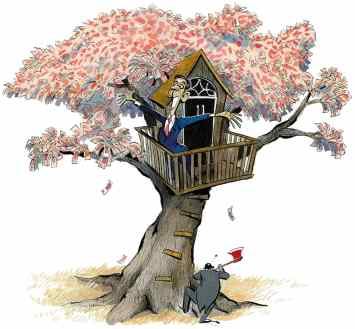

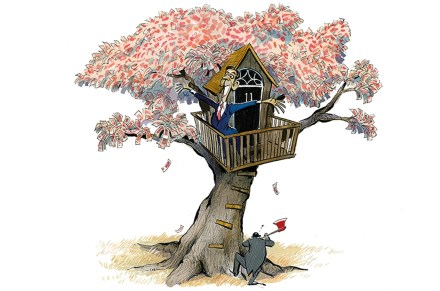

Boris could pay a heavy price for his tax hikes

Given the enthusiasm for tax cuts usually shown by Conservative MPs it is remarkable how few of them have, in public, raised objections to the government’s loose fiscal policy. True, the Prime Minister’s announcement of a hike in National Insurance ostensibly to pay for social care, elicited squeals from the back benches, yet last month’s Budget drew only muted objections. This was in spite of claims by the Resolution Foundation that the Budget will cost an average household £3000 a year – if you take into account the effect of higher prices as businesses seek to pass on their higher tax bills to consumers. Today, however, Mel Stride, former Treasury