The economy adds to Cameron’s woes

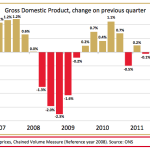

This morning brought the economic news that the coalition has been dreading: the country has double dipped. Now, this is based on preliminary figures which may well be revised up. But, as Pete says, the political impact of this story will be huge. The government’s handling of the economy has now been caught up in this whole argument about competence. It provides quite a back-drop to Rupert Murdoch’s testimony today. PMQs today has now taken on a special significance. Ed Miliband has two massive targets to aim at, the Jeremy Hunt revelations from yesterday and these GDP figures. For Cameron it will be his most testing appearance at the despatch