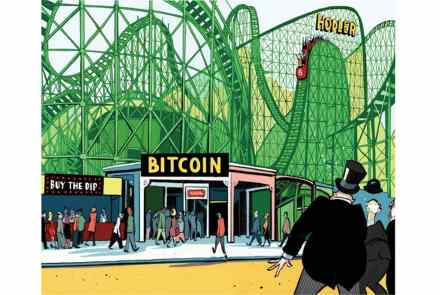

Crypto keeps bouncing back

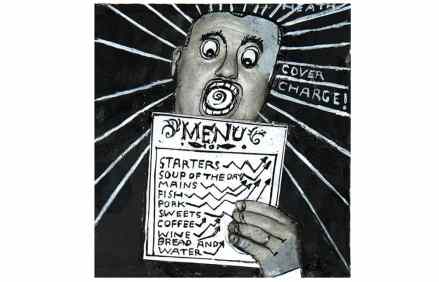

This time it was surely all over. As inflation started to rise towards a 40-year high, as central banks started raising interest rates for the first time in more than a decade, and as the monetary printing presses finally stopped running, the cryptocurrencies crashed. What a crash it was. Bitcoin, the best-known crypto, fell all the way from $61,000 last November to less than $19,000 in June, a spectacular drop of more than two thirds. Ethereum, Solana and other, frailer ‘coins’ – as well as the even flimsier digital collectors’ items known as NFTs – all tanked. This appeared finally to confirm what the doubters had said all along. Cryptocurrencies