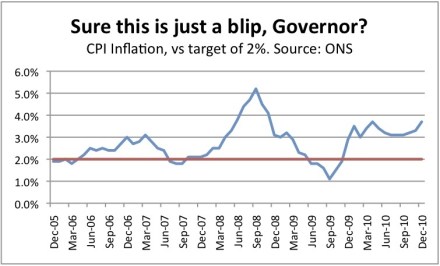

The inflation crisis deepens

How big does inflation have to get before our politicians admit that it’s a problem? Once again, it has “surprised” on the upside – the CPI index stood at 3.7 percent for December, against a supposed target of 2.0 percent. And the RPI index, which the nation called “inflation” until Gordon Brown asked the media to use CPI instead, is running at 4.8 percent – almost twice its former target of 2.5 percent. That is the painfully high figure to which George Osborne has just added a juicy VAT increase, which is bound to take CPI above 4 percent. Inflation has been above target for three of the last four