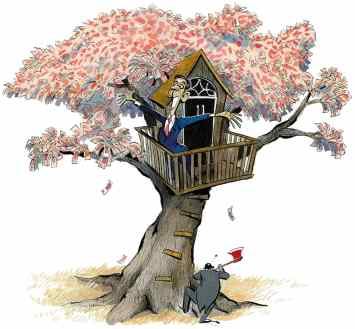

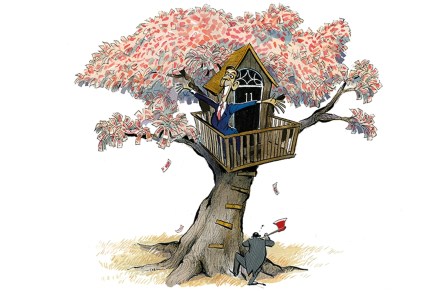

Sunak faces the free-marketeers

Rishi Sunak didn’t give too much away tonight when he spoke in the ‘ThinkTent’ at Conservative Party Conference. The Chancellor is known for being cautious with his words, and has been increasingly tight-lipped in the weeks leading up to his October Budget. But his presence at the fringe event was telling in itself. Sunak was only billed for one public fringe event this year, co-hosted by the Institute of Economic Affairs and Taxpayers’ Alliance. Their ‘ThinkTent’ boasts some of the most free-market, libertarian events you’ll find at conference: both organisations are strong advocates for a low-tax, smaller state. So, not necessarily an obvious place to find the Chancellor who has overseen record peacetime