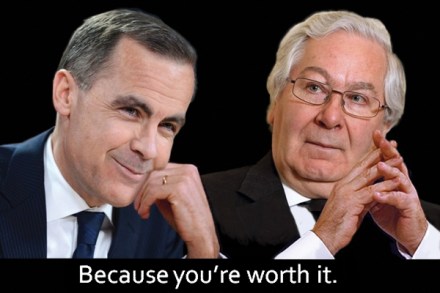

The Battle for Threadneedle Street

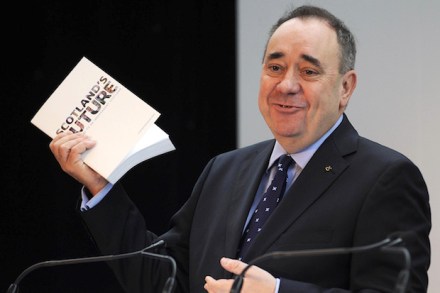

I thought it obvious that Mark Carney’s trip to Scotland yesterday was a bad day for Alex Salmond and the Scottish nationalists. Sure, the governor of the Bank of England said, a currency union between Scotland the the rump UK could happen and be made to work but it would be fraught with difficulty and sacrifice too. Do you really want to do that? How lucky do you feel? Carney, being a Canadian and therefore a man crippled by politeness, did not add “punk”. In response the SNP were reduced to pushing a meaningless poll which found 70% of Britons favouring a currency union after independence. That is, 70% of