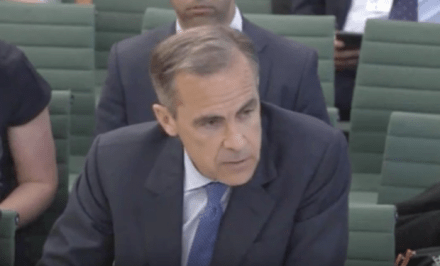

Bank of England holds the base rate at 0.5 per cent

So, the Bank of England didn’t do it: against market expectations that there would be a cut, the base rate has been kept at 0.5 per cent, where it’s been since March 2009. The pound shot up by 1.5¢ against the dollar on the news. #BankRate maintained at 0.5% and Asset Purchase Programme at £375bn. The MPC voted 8-1 on #BankRate and unanimously on the APP. — Bank of England (@bankofengland) July 14, 2016 The Bank is keeping its powder dry and today’s hold doesn’t mean there isn’t a cut coming: The Monetary Policy Committee is meeting again in three weeks’ time when it will have new forecasts for the economy and more