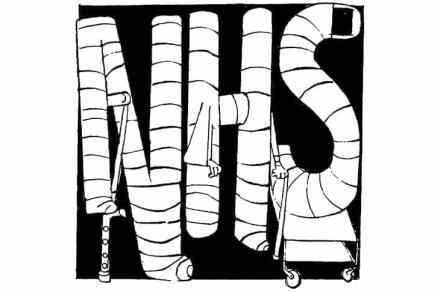

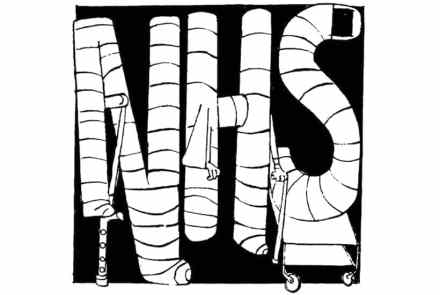

Revealed: how the NHS waiting list will hit 9.2 million

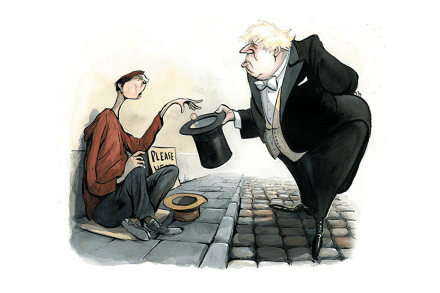

Before the pandemic hit, NHS England waiting lists were at a record high of 4.4 million. Three lockdowns later, they’ve risen to six million: an unacceptable figure for a Tory government which has spent years trying to rebrand itself as the ‘party of the NHS’. Boris Johnson’s decision to break his manifesto pledge and raise taxes was directly linked to the idea that the money would first be funnelled into the health service to fix the backlog. So can he now deliver for patients? When Health Secretary Sajid Javid announced his ‘elective recovery plan’ in the House of Commons on Tuesday, he said that the waiting list would start shrinking