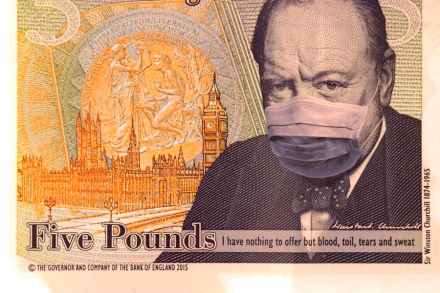

Why next year could bring a 1980s-style spending boom

Most forecasts for the economy are pretty grim: bankruptcies, bad debts, job losses and a massive debt hangover leave little room for optimism. But I’m going to try. I think there is a wodge of money burning a hole in UK consumers’ pockets. And once they can, households will go out and spend it. This wall of money can be seen in the savings ratio — the amount of income that households save. For decades it has wobbled around 10 per cent. But the latest figures from the Office for National Statistics (ONS) show that households are now saving an astonishing 30 per cent of their income. It’s never been