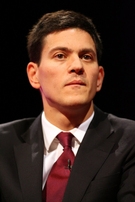

Darling struggles to find consistency

Alistair Darling’s got an interview in today’s FT, and you know the story by now. Yep, the government thinks that borrowing needs to come down drastically; extra growth would go towards cutting the structural deficit; there’ll be the “toughest settlement” on public spending for twenty years, only it shouldn’t be introduced too quickly; those bankers aren’t quite as evil as previously suggested; and so on and so on. As we’ve said before, it’s certainly an improvement on that fatuous investment-vs-cuts line. But you’ve got to wonder whether the public will find it credible, in view of what Brown & Co. have said, and done, in the past. Reading the complete