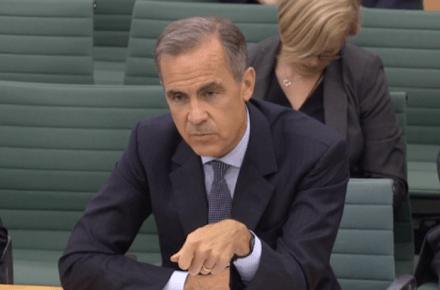

Meet the new leaders of Project Soft Brexit: Mark Carney and Philip Hammond

As double acts go, it is probably not up there with Eric and Ernie, John and Paul, or even Liam and Noel. Even so, Mark and Phil, the Governor of the Bank of England Mark Carney and the Chancellor of the Exchequer Philip Hammond, certainly looked today as if they were working in tandem to try and steer the country towards a gentler version of Brexit than some of the harder men of that movement would prefer. Anyone listening to their speeches in the City this morning, postponed from last week in the wake of the Grenfell Tower tragedy, will have seen immediately what they were up to. Carney was at pains