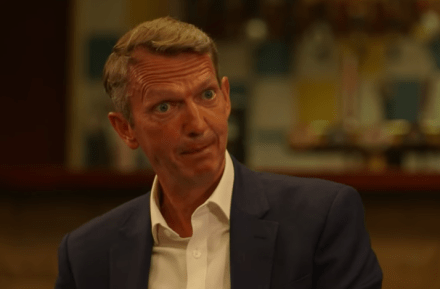

Inflation rises again. The BoE has questions to answer

Inflation is back, and while some people continue to cling to the idea that its resurgence is a temporary phenomenon, today’s figures further stamp out that optimism. Consumer inflation was up to 4.2 per cent in the year to October, a surge from just over 3 per cent the month before. This takes inflation to its highest level since 2011, with prices only set to rise further heading into 2022. Why has the Bank been so insistent about the temporary nature of this round of inflation? Much of the rise is due to increasing energy costs, which were always expected to worsen this winter: global shortages continue to bite as the