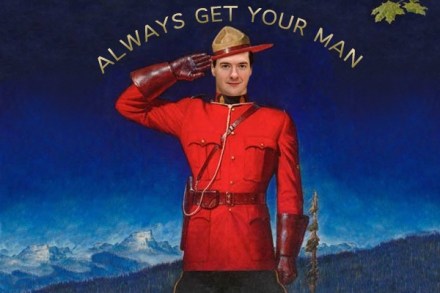

Like the Mounties, Osborne gets his man

George Osborne pulled off one of those bits of political theatre that he so enjoys today. Watching his statement in the Commons, one sensed something was up as Osborne delighted in delaying naming the new bank governor. It was an indication that, like the Mounties, the Chancellor had got his man. Moments later, a clearly delighted Osborne announced that Mark Carney, the Canadian Central Bank Governor, would be the new governor of the Bank of England. This is quite a coup for Osborne as Carney is widely regarded as the best central bank governor in the world. It also marks a clear break with all that has gone wrong in