Two reasons why Andy Haldane is right to worry about inflation

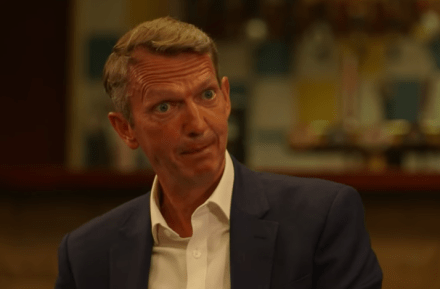

Companies are facing critical shortages of staff. Commodity prices keep spiking upwards. Central banks are printing money on an unprecedented scale, and governments are running deficits of a size that haven’t been seen in peacetime before. What could possibly go wrong? Well, quite a bit, as it happens. And the departing chief economist of the Bank of England Andy Haldane is completely right to warn that the real risk we face over the next couple of years is not a prolonged slump, but a re-run of the spiralling prices of the 1970s. To his credit, Haldane was seldom afraid of challenging orthodox views during his time at the Bank. Now